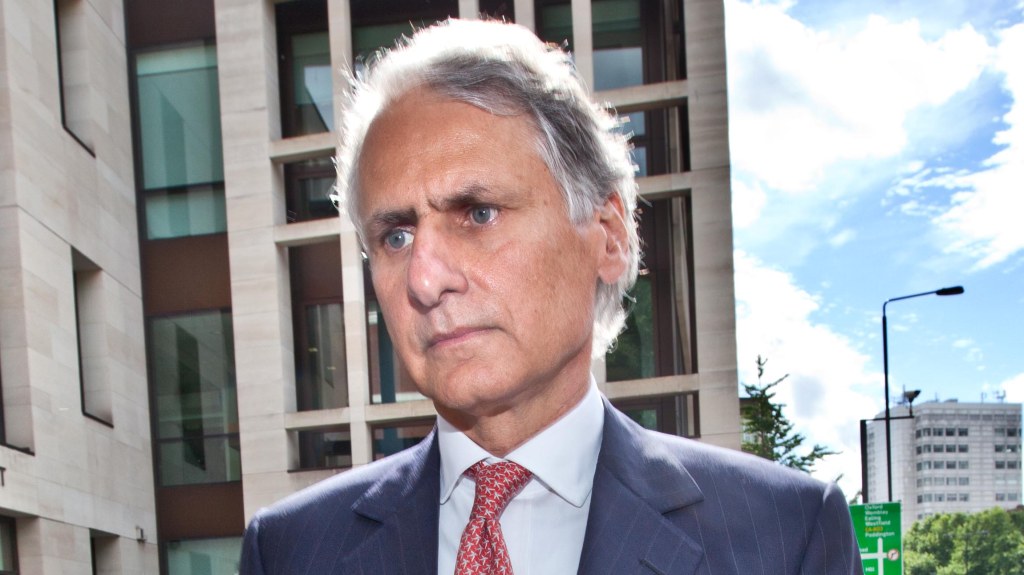

Former Barclays Executive Found to Have Misled Financial Regulators

Tom Kalaris, the former chief executive of Barclays’ wealth division, was found to have provided “false and misleading” statements to regulators regarding the bank’s undisclosed payment of £332 million to Qatar during the financial crisis.

Kalaris has been banned from assuming a senior role in the UK financial sector following the loss of his appeal at an upper tribunal. This decision follows a four-year period after Kalaris and two of his colleagues were acquitted of fraud allegations related to the payments.

The tribunal concluded that Kalaris’s responses during an interview with the Financial Conduct Authority (FCA) in 2013 were deemed “dishonest,” while his subsequent statements to FCA representatives in 2014 were classified as “false and misleading.”

As a result, the tribunal ruled that Kalaris was “not fit and proper to perform the chief executive and executive director roles” for Saranac Partners, a wealth management firm he co-founded after exiting Barclays in June 2013.

A preliminary finding from the FCA in 2022 described Kalaris’s comment to a colleague about the payment: “None of us wants to go to jail here … the food sucks and the sex is worse.”

The tribunal’s ruling was based on a standard of balance of probabilities, differing from the criminal trial criteria that require proof beyond a reasonable doubt for a conviction.

In 2022, the FCA blocked Kalaris from running Saranac after which he contested the ruling, leading to the tribunal’s latest findings released earlier this week.

The case sheds new light on Barclays’ actions in 2008, when the bank made undisclosed payments to Qatar to facilitate two major capital-raising efforts totaling £11.8 billion, averting a government bailout.

Laura Dawes, director of authorisations at the FCA, commented on the tribunal’s ruling: “We welcome the verdict which determined that Mr. Kalaris was dishonest in two interviews regarding events during his time at Barclays. He is not suitable to hold a senior management position in a regulated business, highlighting the importance of integrity and transparency in the leadership of financial institutions.”

Kalaris, alongside former Barclays bankers Richard Boath and Roger Jenkins, was acquitted of charges in February 2020 after a lengthy trial at the Old Bailey, where the Serious Fraud Office alleged that the favorable terms provided to Qatar were concealed from the market through misleading advisory arrangements.

During tribunal proceedings, Kalaris’s attorney referred to his extensive 40-year career in high-level financial services, asserting that no concerns had been raised about his conduct throughout that time.

Kalaris, aged 68, currently maintains a role at Saranac but did not provide a personal comment regarding the tribunal’s findings.

Saranac expressed disappointment but accepted the tribunal’s conclusions, emphasizing that the matters at hand predated the firm’s establishment and were unrelated to its operations. The verdict did not criticize Saranac Partners or its business activities.

Barclays has opted not to comment on the case as it simultaneously contests a separate £50 million fine imposed by the FCA for its actions during the Qatari fundraising efforts.

Saranac Partners, located in London’s St James’s district, manages £5 billion in assets for both institutional and private clients, featuring a notable board that includes Martin Gilbert, the former CEO of Aberdeen Asset Management, and Jerry del Missier, a former colleague of Kalaris at Barclays.

Del Missier resigned following the Libor interest rate rigging scandal, where his association with the bank came under scrutiny.

Post Comment